Recent management studies support the notion that diversity on boards enhances firm comparability. Unfortunately, this link remains unexamined in emerging-market settings.

This study investigates the influence of board gender, age, education and task diversity on accounting comparability in Bangladeshi context. Results demonstrated that greater overall board and audit committee diversity leads to better financial reporting quality.

Gender Diversity

Gender diversity on boards has been shown to contribute positively to performance, although its effects can differ depending on various contextual factors. Gender diversity tends to work best in firms with high executive ownership levels and employ a higher proportion of women workers than other sectors; additionally, manufacturing firms stand out with regards to gender diversity among board members.

This study utilizes panel data to explore the effect of gender diversity on integrated reporting quality (IRQ) and identify its moderating effects. More specifically, regression techniques and two-way interactions were employed by authors to explore relationships between gender diversity and IRQ for both manufacturing and non-manufacturing companies using gender diversity data as moderating variables.

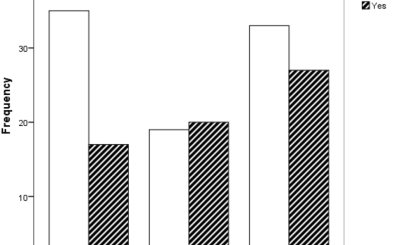

Results show that gender diversity has an overall positive effect on audit committee IRQ scores; its effect is stronger in manufacturing than non-manufacturing sectors. Gender diversity moderates the effect of audit committee size and independence on audit committee IRQ ratings; this finding suggests gender diversity may increase effectiveness by permitting more inclusive discussions during committee meetings.

Age Diversity

While some studies suggest a positive influence of age diversity on company performance, other reports demonstrate its negative impact. One potential explanation could be value-related diversity having different effects depending on which culture it occurs within.

This study investigates the effects of age diversity on company risk and performance using pooled OLS models. Table 3 displays these regression results.

Results indicate that age diversity positively impacts company risk and correlates positively with ROA; it was however negatively related to quality audit and nationality diversity, suggesting its positive effect may come from its advising and monitoring functions. Two-sample 2SLS-IV regressions with CapitaMosque and CapitaCourse external instruments support these findings, with their two-sample regression results supporting it further. Furthermore, Hofstede’s cultural dimensions indicate its effect is stronger in societies with high collectivism as measured by Hofstede than in societies less susceptible.

Education Diversity

According to prior research, board diversity can improve integrated reporting quality by reducing information asymmetry and agency problems, helping prevent earnings smoothing and enhance firm performance (Mostafa Mohamed & Hussien Habib 2013).

This research explores the relationship between audit committee attributes and integrated reporting quality using data from six Gulf Cooperation Council countries. The results reveal that audit committee members with diverse backgrounds have a positive effect on IRQ, while also decreasing earnings smoothing as firms increase information in their financial statements to meet reporting standards.

Furthermore, this study investigates the moderating effects of government representatives on these relationships and finds that women in boardrooms can help counteract any effect from board gender diversity on associations between audit committee attributes and IRQ scores. This evidence supports contingency theory and indicates how different factors can shape governance dynamics differently.

Task Diversity

As board members are charged with monitoring and overseeing the management of their firm, it’s vital that they come from different backgrounds and perspectives. Unfortunately, many boards select candidates according to whether or not they fit a certain category; this prevents productive discussions from taking place on board meetings.

This study seeks to investigate how different aspects of board diversity influence financial distress. By drawing upon China’s unique institutional environment and transition economy, this research investigates whether there exists any correlation between board characteristics and restatements and financial distress.

Results indicate that functional diversity, nationality and social networks have a positive effect in reducing risk, while age and gender differences only have minor ramifications. Furthermore, inside network diversity had a substantial effect on mitigating risk while outside network diversity had only minor repercussions; regression models estimate these variables’ effects across five risk measurements.